MOSCOW EXCHANGE GROUP PROFILE

2-1

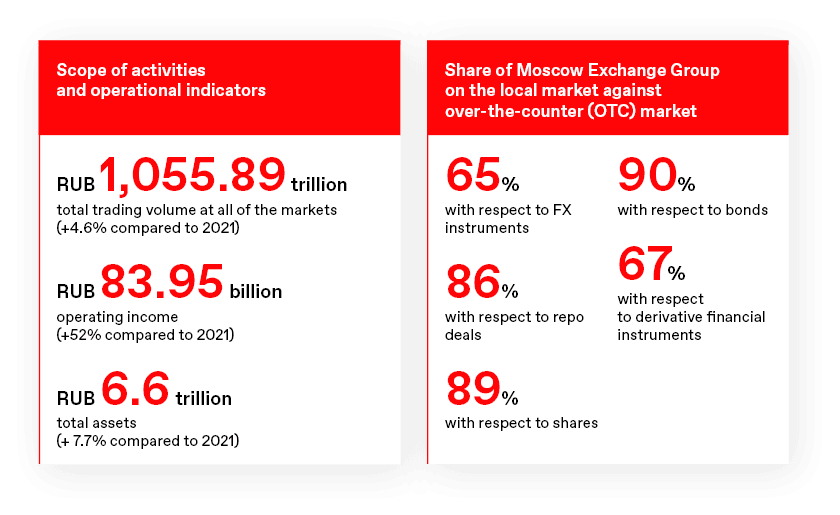

Moscow Exchange Group is the largest exchange in Russia, as well as Central and Eastern Europe, in terms of the trade volume of its main asset classes; it also has the largest stock market capitalisation. It plays a key role in the development of the Russian financial sector.

The Group provides a full cycle of trading and post-trading services on five markets (Equity, Bond, FX, Money, Commodities and Derivatives Markets) to individuals and legal entities, implementing the principle of full vertical integration of a trading operator with a clearing house acting as a central counterparty and central securities depository, creating a unique integrated platform together. Securities of companies from all sectors of the economy are represented on Moscow Exchange.

The traditional B2B business model is being transformed into a B2B2C model, where investors trade through licensed participants (broker banks) and have direct access to the financial marketplace, the Finuslugi platform.

2-1 2-6

The Group operates in Russia, and it has a single customer service centre located in Moscow.

Moscow Exchange Group includes Moscow Exchange MICEX-RTS PJSC (Public company), which operates the only multifunctional exchange platform in Russia for trading in equities, money market instruments, derivatives, foreign currencies, precious metals, and other assets. Moscow Exchange PJSC provides trading opportunities for equities, bonds, derivatives, currencies, money market instruments, and commodities.

In 2022, about 6,000 local and 1,000 global instruments, including ESG instruments, were traded on Moscow Exchange.

2-6