MOEX GROUP’S FOCUS AREAS: ‘GREAT’

G | GENUINE CORPORATE GOVERNANCE AND BUSINESS ETHICS

Moscow Exchange Group adheres to best practices and standards in corporate governance, ethics, and business conduct. The Group is also developing a system for internal control and risk management. Sustainability principles are reflected in the activities of the Group’s corporate governance bodies. The scope of issues considered at Supervisory Board meetings is expanding. Moscow Exchange continues to develop policies to regulate the management of sustainability-related issues, implementing best practices in business conduct among the Group’s companies, in the supply chain, and also among issuing companies and other financial market participants.

Moscow Exchange Group’s objectives and the UN Sustainable Development Goals:

- SDG 5.5 Ensure gender balance at the Group

- SDG 5.5 Promote gender equality in the business environment

- SDG 12.6, 13.3 Raise companies’ awareness of sustainability-related trends, standards, and practices

- SDG 4.7 Ensure the Group’s personnel have the competencies they need to manage sustainability issues effectively

Shareholder | 31 December 2022 | |

|---|---|---|

Voting power (voices) | Voting power (%) | |

Central Bank of the Russian Federation | 268,151,437 | 11.780 |

Sberbank of Russia | 227,682,160 | 10.002 |

VEB.RF | 191,299,389 | 8.404 |

EBRD | 120,472,902 | 5.292 |

State Street Bank & Trust Company | 119,663,685 | 5.257 |

MICEX-Finance | 18,829,079 | 0.827 |

Free float (excl. MICEX-Finance; incl. State Street Bank & Trust Company) | 1,449,966,491 | 63.696 |

2022 highlights

This subsection describes the Moscow Exchange Group efforts in developing the compliance system, projects aimed at combating corruption and increasing adherence to ethical principles of business conduct, as well as at further improving the quality of corporate governance in the companies of the Group.

Figures for 2019, 2020, 2021 and 2022 are available in the Genuine corporate governance and business ethics subsection of the Key Sustainability Data section. See the Genuine corporate governance and business ethics subsection of the Sustainability Approaches and Procedures section for information on key policies, procedures, and responsible departments.

Corporate governance

2-9

The corporate governance structure of Moscow Exchange consists of the General Shareholders Meeting, the Supervisory Board, the Executive Board, and Chairman of the Executive Board, who is Chief Executive Officer.

General Shareholders Meeting

Moscow Exchange’s share capital structure is notable for:

- the absence of a controlling shareholder or shareholders with a stake exceeding 12%;

- high share of free float (64%).

Moscow Exchange strives to balance its shareholders’ interests; it performs its infrastructural function on the financial market effectively.

According to the Charter of Moscow Exchange, each share entitles the holder to one vote at the General Shareholders Meeting. See the 2022 Annual Report of Moscow Exchange and the official website for more details on the decisions made at general shareholders meetings.

Supervisory Board

In order to comply with the corporate governance requirements established by the Listing Rules, as well as to ensure the fullest compliance with the Corporate Governance Code of the Central Bank of the Russian Federation, the following measures were taken in 2022:

2-9 2-10 2-11 2-17

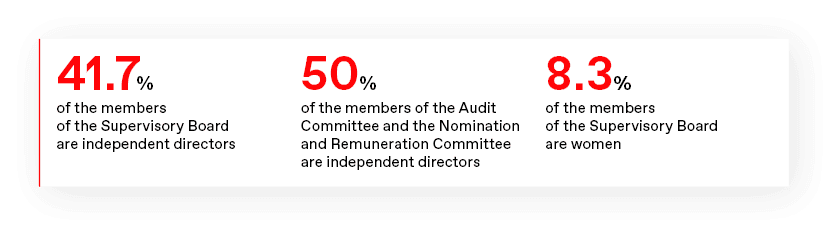

- 11 non-executive directors were elected to the 12-member Supervisory Board, including five independent directors;

- all independent directors meet the independence criteria set by the Listing Rules;

- the Audit Committee and the Nomination and Remuneration Committee consist of independent members of the Supervisory Board;

- a non-executive director was appointed as Chairman of the Supervisory Board;

- in accordance with clause 12.2 of the Charter of Moscow Exchange, the members of the Supervisory Board are elected by the General Meeting of Shareholders for a term until the next Annual General Meeting of Shareholders and may be re-elected an unlimited number of times;

- the proportion of women on the Supervisory Board is 8.3%;

- the principle of forming the Supervisory Board and the Executive Board is based on the professional competences of the members of the Supervisory Board or the Executive Board, respectively;

- the Exchange seeks to ensure that different age groups are represented on the governing bodies; to date, these include those aged 40+, 50+, 60+ and 70+;

- the Supervisory Board brings together professionals with diverse profiles (entrepreneurial, functional, country-specific) and international competencies (in the area of the exchange industry, digital products and finance), which enables the Supervisory Board to address issues comprehensively and engage in meaningful discussions from different perspectives. Two members of the Supervisory Board hold positions in higher education institutions and are representatives of the academic and student communities.

- Regulators and authorities

- Shareholders and Investors of Moscow Exchange

- Market participants and their clients

- Issuers

- Employees

Members of the Supervisory Board | Total length of service (years) | Number of other positions (other than with Moscow Exchange) |

|---|---|---|

Director 1 | 14 | 2 |

Director 2 | 13 | 0 |

Director 3 | 8 | 3 |

Director 4 | 1 | 1 |

Director 5 | 1 | 0 |

Director 6 | 1 | 0 |

Director 7 | 1 | 1 |

Director 8 | 3 | 0 |

Director 9 | 1 | 1 |

Director 10 | 1 | 1 |

Director 11 | 1 | 0 |

Director 12 | 3 | 5 |

In 2022, two strategy sessions were held to dive into the specifics of the Moscow Exchange Group’s business, discussing various aspects of Moscow Exchange’s business development, including areas such as technology development, the Sustainability Sector, the carbon unit market and risk management.

Further work on these issues is planned in the Group companies.

2-16

The Supervisory Board keeps abreast of critical issues through a specialised system for supporting the governing bodies’ activities. Once information on critical issues is received, all Supervisory Board members are sent a special notification. In the reporting year there were no critical issues that would require the involvement of members of the Supervisory Board.

In 2022, the following committees operated under the Supervisory Board, carrying out preliminary consideration of issues and preparing decision-making recommendations:

- Strategic Planning Committee;

- Audit Committee;

- Nomination and Remuneration Committee;

- Risk Management Committee;

- Technical Policy Committee;

- Corporate Governance Committee.

The Supervisory Board’s decision to form a new Corporate Governance Committee was taken at the end of December 2022, and as a result, no meetings of the Committee were held during the year.

2-9 2-12 2-13 2-15

Committee | Key tasks | Number of meetings |

|---|---|---|

Strategic Planning Committee | Improving the efficiency of Moscow Exchange and its subsidiaries through preliminary consideration and preparation of suggestions for the Supervisory Board on the preparation, development, and implementation of long- and medium-term strategic plans and objectives for Moscow Exchange | 3 |

Audit Committee | Ensuring the effective work of the Moscow Exchange Supervisory Board in resolving issues related to control over financial and economic activities (including audit independence), verifying the absence of conflicts of interest, and evaluating the findings of audits of Moscow Exchange’s financial statements | 11 |

Nomination and Remuneration Committee | Ensuring the effective work of the Supervisory Board in resolving issues related to the activities of Moscow Exchange and of companies under the direct or indirect control of Moscow Exchange with regard to nomination and remuneration of the members of supervisory boards and governing bodies, as well as of other key executives and members of audit committees | 13 |

Risk Management Committee | Participating in the improvement of the risk management system of Moscow Exchange and the Group in order to improve the reliability and efficiency of Moscow Exchange’s operations | 10 |

Technical Policy Committee | Developing and improving the efficiency of Moscow Exchange and the Group by preparing recommendations and expert opinions covering technical policy and the development of IT and software for the Supervisory Board, the boards of directors (supervisory boards) of the Group’s companies and their committees, and for the governing bodies of Moscow Exchange and the Group’s companies | 6 |

Corporate Governance Committee | Preparing and negotiating with NSD’s minority shareholders a draft new version of the Shareholders Agreement, making recommendations to the Supervisory Board of NSD for making the necessary corporate approvals in relation to the Shareholders Agreement, and developing and submitting recommendations to the Supervisory Board of Moscow Exchange and the Supervisory Boards of Moscow Exchange Group companies on corporate governance quality improvement issues, as well as on issues aimed at resolving disputes arising between Moscow Exchange Group companies in the process of coordinating corporate governance matters | 0 |

2-24

The Supervisory Board approves risk appetite and risk management policies (including by topic), reviews reports on the risk management system, and decides on corrective measures based on those reports.

The Supervisory Board has a Risk Management Committee that also involves other companies of the Group in its activities.

2-19 2-20

Each Supervisory Board member is paid a fixed amount, depending on :

- the Supervisory Board member’s status (compliance with the independence criteria);

- additional functions performed (as chairman or deputy chairman of the Supervisory Board);

- contribution to the work of the committees under the Supervisory Board (as committee chairman or member);

- attendance at meetings.

Indicator | Amount (RUB thousand ) |

|---|---|

Remuneration for work in the governing body | 185,324.02 |

Salary/wage | 0.00 |

Bonus | 0.00 |

Commission fees | 0.00 |

Expense reimbursement | 0.00 |

Other types of remuneration | 290.28 |

Total | 185,614.30 |

Evaluation of the effectiveness of the Supervisory Board and its committees

2-18

Prerequisites and grounds for the evaluation

In accordance with the recommendations of the Corporate Governance Code and international best practices, Moscow Exchange annually evaluates the effectiveness of the Supervisory Board. Pursuant to internal regulations, the Nomination and Remuneration Committee of the Supervisory Board engages external consultants regularly (once every three years) to conduct an independent evaluation.

In 2022, the external evaluation was conducted by Ward Howell, an independent consultant selected by the Supervisory Board after reviewing applications. In addition to the cost of services, the selection criteria included: the consultant’s experience in implementing similar projects, academic and practical expertise in corporate governance, and the experience and level of professionalism of the project team. In addition, Ward Howell had already conducted an external evaluation by the Supervisory Board of Moscow Exchange in 2019, which ensured the continuity of the evaluation methodology.

Evaluation objectives and purposes

The objectives of the evaluation are to monitor the dynamics of changes in the work of the Supervisory Board and the commissions and to identify areas for improving the effectiveness of the Supervisory Board and its individual members. In addition, a particular focus of the 2022 evaluation was the vision of the Group’s corporate governance model.

In order to achieve these objectives, the following tasks were carried out:

- the role and functions of the Supervisory Board and committees in the corporate governance system of the Company were assessed;

- the composition of the Supervisory Board and committees in terms of its balance and the effectiveness of the formation process was analysed;

- the priorities of the Supervisory Board and committees were identified;

- the effectiveness of the Supervisory Board and Committees’ processes and procedures was evaluated;

- the effectiveness of interaction between Moscow Exchange and its subsidiaries was evaluated;

- the dynamics of the Supervisory Board and Committees meetings was reviewed;

- the contribution and effectiveness of the chairman of the Supervisory Board, the chairmen of the committees and the corporate secretary were evaluated;

- an individual assessment of the level of involvement and preparation for Supervisory Board meetings was carried out;

- recommendations were made to improve the work of the Supervisory Board and its collegiate bodies, form optimal composition, plan succession and carry out training and development activities.

Evaluation methodology

The consultants used several tools to gather the necessary information and obtain the most objective results:

- analysis of internal documents;

- analysis of video recordings of meetings of the Supervisory Board and committees;

- questionnaire survey of Supervisory Board members and management representatives;

- interviews with members of the Supervisory Board, Exchange management and representatives of the Supervisory Board and management of NCC;

- an individual 360-degree evaluation of the members of the Supervisory Board.

Members of the Supervisory Boards and management representatives of Moscow Exchange and NCC actively participated in the evaluation. The main evaluation tool, the structured interview, covered 32 people (94% of the envisaged evaluation participants). The external consultant notes the high quality of the feedback and the openness of the participants during the interviews. For members of the Supervisory Board and the management of Moscow Exchange, participation in the survey was also envisaged - more than half of all management representatives of the Exchange and half of all directors of the board were included in the survey. The participation of NCC was only foreseen during the interview phase (100% of participants were interviewed). Involving participants from different groups allowed the widest and most objective assessment to be obtained.

Evaluation results

Based on the results of the 2022 evaluation, the Supervisory Board has significantly improved its performance in some aspects of its work that were highlighted as areas for development in the previous external evaluation in 2019, namely the quality of the Supervisory Board’s interaction with management; the quality of interaction with the regulator, the Bank of Russia; strengthening competencies in IT, digital product development and operational risk; reducing agenda overload and reducing the number of formal issues.

Among the strengths of the Supervisory Board, the following aspects particularly stood out:

- effective dialogue between the Supervisory Board and management: clear separation of powers, minimal interference by the Supervisory Board in operational management, increased trust, increased management autonomy, mutual support and a high speed of interaction;

- professional and diverse composition The evaluation considered the composition of the Supervisory Board, which functioned until February 2022. : the Supervisory Board brings together professionals with diverse profiles (entrepreneurial, functional, country-specific) and international competencies (in the area of the exchange industry, digital products and finance), which enables the Supervisory Board to address issues comprehensively and engage in meaningful discussions from different perspectives. There is also gender and age diversity on the Supervisory Board;

- leadership style of the Chairman of the Supervisory Board: the Chairman is deeply involved in the work of the Supervisory Board, supports directors and management, effectively manages relations with key stakeholders, and represents the company externally;

- Corporate Secretary and support for the Corporate Governance Department: the Corporate Secretary promptly implements best corporate governance practices and ensures the effective operation and support of the Supervisory Board.

Remuneration of executives at Moscow Exchange

2-19

- a fixed component (salary);

- a variable component, including a short-term element (annual bonus) and a long-term element (remuneration under the Long-Term Incentive Programme Based on Shares).

The short-term variable component depends on whether the approved KPIs have been met, including general corporate and individual indicators. In contrast to 2021 with the ratio of 50/50, in 2022 it was decided that for all members of the executive bodies, corporate goals are to become equal to individual, meaning that corporate goals are to form 100% of indicators. For the Chairman of the Executive Board of the Exchange, this practice has been applied since 2020.

In order to increase the responsibility of executives, the Long-Term Incentive Programme was launched, granting them the right to receive shares in stages.

Type of payment | Amount of payment (RUB thousand) |

|---|---|

Remuneration payable separately for participation in the governing body’s activities | 0.00 |

Salary | 132,646.16 |

Bonuses | 228,571.89 |

Commission fees | 0.00 |

Other types of remuneration | 130.70 |

Total | 361,348.76 |

2-21

Due to existing market practices and high sanctions risks, it was decided not to disclose information about the remuneration of the most senior official of Moscow Exchange Group and the ratio of his remuneration to the median remuneration of the Group’s employees.

Reliability of information on issuers

Moscow Exchange’s stance is consistent with international practice regarding the public disclosure of information by listed companies; financial, production, and ESG data; and changes that may affect share prices.

See the “Advanced practices of Responsible investing” subsection for details on requirements for issuers to disclose information that could affect the value of shares.

3-3

In 2022, Moscow Exchange updated its Listing Rules, which define the conditions and procedures for placement on the financial platform, the rules for delisting various types of securities, and other important details. According to this document, the inclusion of securities on the quotation list is subject to the following requirements:

- compliance of the securities with the current legislation of the Russian Federation, including regulatory acts of the Bank of Russia;

- assumption by the issuer of the obligation to disclose information in accordance with the requirements of the Law on the Securities Market and other legal acts of the Russian Federation, including regulations of the Bank of Russia.

Moscow Exchange conducts a review of securities for which applications have been submitted, checking issuers’ compliance against Moscow Exchange’s listing requirements. When preparing an expert opinion, the Listing Department considers official documents received by Moscow Exchange, information disclosed or submitted by the issuer, and messages posted on the websites of competent (regulatory) government authorities and organisations (self-regulated organisations, settlement depository, ratings agencies, organisations specialising in expert review of environmental and social projects, etc.). It may also consider information from the media and other sources.

Moscow Exchange monitors the compliance of market participants’ activities with the listing requirements. Should a violation of these requirements be detected, Moscow Exchange reserves the right to set a deadline to rectify it or to delist the securities.

The NCC is guided by the Rules of Clearing on the stock market, the deposit market, and the loan market.

In 2021, the Bank of Russia published an information letter containing recommendations on disclosure by public joint-stock companies of non-financial information about their activities: companies are recommended to voluntarily disclose information on sustainability and ESG factors — including corporate governance, — as well as environmental and social performance. Moscow Exchange supports the initiatives of the Bank of Russia.

Compliance system

Compliance is a crucial aspect of good corporate governance. The Group has built a compliance management system with developed business processes, procedures, corporate policies, and local regulations; risk assessments are carried out regularly (at least once a year) in all compliance areas.

Developing a corporate compliance culture, developing a unified approach to compliance risk management, as well as quality support for business processes in the face of a significant number of new regulatory requirements became one of the main areas of focus for corporate governance in 2022.

In 2022, Moscow Exchange successfully passed an independent audit and receive a certificate confirming compliance of its corporate compliance system with ISO 37301:2021 Compliance Management System. The audit covered the following areas:

- anti-corruption;

- countering the legalisation (laundering) of the proceeds of crime and the financing of terrorism;

- countering the misuse of inside information and market;

- manipulation;

- settlement of conflicts of interest;

- exerting internal control over organised trading and activities as a financial platform operator;

- monitoring compliance with the tax legislation, including international legislation (CRS, FATCA), and with economic restrictions.

In 2022, the Exchange successfully completed an operational audit in accordance with International Standard on Assurance Engagements 3402 (ISAE 3402), which resulted in a SOC 1 Type 1 report expressing an independent auditor’s opinion on the effectiveness of the design and implementation of control procedures for the following processes:

- admission of financial platform clients;

- admission of trading members;

- listing.

- internal compliance involves ensuring that the activities of the Group’s companies comply with mandatory and voluntary requirements;

- the external compliance includes areas related to: 1) formalisation of requirements for issuers and bidders in the field of compliance; 2) informing market participants about best practices; 3) creation of compliance products for market participants.

“Compliance: Key Trends 2022” conference was held for market participants in 2022. The event looked at trends and modern compliance technologies to improve the quality of regulatory risk management.

Group’s compliance practices

2-15 2-16 2-26

In accordance with the “Three Lines of Defence” model, the Supervisory Board of Moscow Exchange approves the Code of Professional Ethics, reviews reports, and assists in developing the ethics function. The managing director for compliance and business ethics is responsible for ethics and compliance-related issues; he/she is directly subordinate to the chairman of the Executive Board of Moscow Exchange.

The leader of the compliance function may take part in meetings of Moscow Exchange’s management bodies and committees, in risk assessments of new processes and products, and in procurement procedures.

A self-assessment of Moscow Exchange’s compliance system is carried out twice a year; external audits are carried out as part of the annual audit.

Failure by employees to comply with the Code of Professional Ethics and to complete mandatory compliance training affects the results of their annual evaluation.

The Group adheres to the open-door principle: employees are always welcome to ask for clarification, submit questions, or use the compliance portal. Moscow Exchange has developed an initiative to designate active employees (Compliance Ambassadors) who are interested in self-development and refinement of the Company’s compliance procedures. They attend training sessions on topics related to compliance culture, and their initiatives in the field of compliance and ethical behaviour are reviewed and may be accepted.

The Group has designed technological solutions, including a communications channel (the anonymous SpeakUp! hotline — Moscow Exchange own creation) that can be used to report possible instances of corruption or violations of ethical business conduct and law. The latest survey held among the employees of the Moscow Exchange Group shows that 83% of employees are aware of the availability and functionality of the SpeakUp! hotline. All employees are welcome to submit anonymous reports via the hotline and receive a response (applicants are sent a link to a web page where they can check the reaction of the Group’s companies). Moscow Exchange Group adheres to the principle of non-retaliation against employees who report problems.

In addition to the internal channel for employees, the Group has set up an external one for reports of corruption-related issues. Interested parties are welcome to use the hotline on the Moscow Exchange website.

Data on the number of applications received regularly reflected in the Sustainability Report. In 2022, 37 reports were received, including eight on possible professional ethics violations. There were no reports of corruption. All reports regarding potential compliance violations are investigated, and corrective action is taken whenever necessary.

The rest of the reports were general in nature and contained information about new and possibly unfair practices on financial markets, as well as suggestions for improving processes at companies of the Group. All appeals were processed by the Internal Control and Compliance Department; replies were sent within five business days.

Significant fines and breaches of the law

206-1 205-3 3-27

In 2022, there were no significant fines or cases of violation of legislation.

Non-significant violations include one order of the Bank of Russia related to a breach of reporting disclosure rules for 2022, as well as one warning of the Bank of Russia related to identified violations of the Moscow Exchange Trading Rules for the Derivatives Market in conducting the Coloured Prospects competition.

In 2022, no lawsuits (pending or completed during the reporting period) regarding anti-competitive behaviour or violation of antitrust legislation were filed against any companies of Moscow Exchange Group. There have been no confirmed cases of business ethics violations or corruption-related violations over the past three years.

Business ethics and anti-corruption

Corporate ethics and anti-corruption measures are important elements of the compliance system, and they are included in Moscow Exchange’s Compliance Programme. These measures are constantly being improved in order to enhance the efficiency of operational processes, including by preparing reliable reporting, ensuring compliance with applicable laws, and developing a culture of trust in relations with employees and counterparties.

The Group adheres to the principles of staff involvement in achieving zero tolerance of corruption, avoiding conflicts of interest, and ensuring that actions and procedures are proportional to the level of risks identified during periodic risk assessments.

205-2

As part of implementing the zero-tolerance principle, Moscow Exchange Group takes corruption prevention measures aimed at both internal and external stakeholders, including informing and training employees, developing mechanisms for receiving information on corruption risk events, and including anti-corruption clauses in contracts with counterparties.

The percentage of employees who successfully completed anti-corruption training by the end of 2022 was 99.6%.

In 2022, all members of the Supervisory Board were familiarised with the Policy aimed at preventing corruption offences and the Moscow Exchange Code of Ethics.

The Anti-corruption Policy is publicly available; all partners and counterparties are informed of the Group’s stance and the availability of the corruption hotline. All counterparties undergo mandatory checks. Compliance experts are involved in negotiating contracts that may entail corruption risks, including at the procurement stage, as well as in sponsorship and charitable activities.

205-1 205-3

The companies of the Group monitor the effectiveness of and control over anti-corruption procedures. Self-assessments of the quality of corruption risk management are carried out regularly; reports are compiled for the Executive Board and the Audit Committee under the Supervisory Board of Moscow Exchange. Corruption risk assessments are conducted at all 100% of the Group’s companies. In 2022, no incidents of corruption or violations of the Code of Professional Ethics were registered. No significant corruption risks were identified, either.

Interaction with suppliers

414-1

The Group’s companies have transparent conditions for suppliers and contractors who wish to participate in the procurement process through bids and transactions. Guided by internal regulations such as the regulations on procurement, the Group’s companies guarantee the fulfilment of their contractual obligations.

In 2022, management continued to develop the Supplier/Counterparty Code of Business Conduct for the companies of Moscow Exchange Group in order to improve the business environment and reduce risks in the supply chain. It sets out principles of responsible business conduct which Moscow Exchange expects counterparties to comply with and which are to be taken into account during procurements. The code is to be adopted in 2023.

The following corporate governance tasks have been set for 2023:

- to conduct assessment of the Supervisory Board’s effectiveness;

- to determine a pool of successors for the members of the Supervisory Board;

- to formalise the Group’s management system.

To expand the scope of work and assist employees in the area of compliance, the Group’s companies have set the following objectives:

- to implement initiatives in accordance with the Compliance Roadmap;

- to take measures to develop risk and compliance culture.

To implement ESG principles throughout the supply chain, Moscow Exchange Group is planning to take the following actions:

- to approve the Supplier Code of Business Conduct and introduce a procedure for signing a document (or a form) confirming that counterparties are familiar with Moscow Exchange’s requirements;

- to continue improving the planning, consolidation, and automation of procurement procedures for Moscow Exchange Group.

The Group’s plans for 2023 and the coming years in the areas of internal audit, business ethics, and anti-corruption include continuous work on the Compliance Roadmap, which envisages improving procedures and automating compliance-related risk management processes.