E | ENVIRONMENTALLY FRIENDLY AND TRUSTED MARKET INFRASTRUCTURE

3-2 FN-EX-550a.3

A market’s effective functioning and appeal are determined by its infrastructure The stock market infrastructure refers to payment systems, central securities depositories, securities settlement systems, central counterparties and trading repositories. , which should ensure high-quality and accessible information for end-users, brokers, and investors; reliable barriers to deter market manipulation and conflicts of interest; smoothly operating IT systems; and the ability to process substantial flows of information between issuers and providers of capital.

Cybersecurity is an integral part of Moscow Exchange Group’s risk management strategy and system. Measures taken to enhance information security ensure that the quality of management systems and the reliability of infrastructure are in line with global best practices.

This section describes measures that Moscow Exchange Group takes to ensure business continuity, including the reliability of information, data confidentiality, availability of operations, and information security.

Moscow Exchange Group’s objectives and the UN Sustainable Development Goals:

- SDG 9.b Ensure sustainable financial infrastructure

2022 highlights

For data from 2020, 2021 and 2022, see the Environmentally Friendly and Trusted Market Infrastructure subsection of the Sustainability Data section. For the key policies, procedures, and responsible departments, see the Environmentally Friendly and Trusted Market Infrastructure subsection of the Sustainability Approaches and Procedures section.

Risk management

3-3 2-24

The overall risk management system aims to guarantee reliable infrastructure. In 2022, Moscow Exchange Group continued to implement the

The Group’s progress towards achieving the goals and objectives established in the strategy is monitored regularly: status reports are submitted to collegial executive bodies for review. We also use KPIs to assess the effectiveness of the risk management system.

As part of the Strategy and Roadmap, Moscow Exchange has implemented an approach to determining its risk appetite. The component risks carry equal weight and are deemed to be material for the Group and all its companies.

ESG risk management

2-24

The expectations and interests of the Group’s stakeholders align with Moscow Exchange Group’s high level of preparedness for new ESG risks and opportunities. Approaches to identifying priorities and opportunities are determined based on the company’s strategic goals and objectives.

By analysing key sustainability trends, risks, and opportunities at an early stage, the Group can enhance its strategic performance. Prioritising key economic, environmental and social issues as risks and opportunities is an integral part of Moscow Exchange Group’s operations and internal processes.

201-2

Climate-related risk management

In 2022, Moscow Exchange continued to develop the climate risk and capacity management process in line with the TCFD Recommendations, approved the Climate Risk Management Policy, included climate risk in the risk map, and updated the risk and capacity assessments.

As part of the development of climate risk and opportunity management tools, the following tasks are planned:

- Assessment of the risks and opportunities associated with climate change;

- Training employees to anticipate likely events and threats.

The short-term horizon (12 months) includes an annual review of transitional and physical climate-related risks, as well as regular monitoring of the conditions and rules for identifying them. Moscow Exchange incorporates international practices for identifying and assessing climate-related risks into its operations.

The following climate-related risks were identified in the reporting period:

- transition risks, including market, reputational, political, legal, and technological risks;

- physical risks (acute and chronic).

Moscow Exchange Group is expanding its partnerships with various institutions in order to disseminate knowledge and expertise. It is developing models for identifying and assessing climate-related risks. More information on TCFD initiatives can be found in the Climate Agenda subsection.

In the reporting year, Moscow Exchange Group achieved all its goals and objectives. This lays a solid foundation to further develop the risk and opportunity assessment process with respect to sustainability.

Emerging risks are identified systematically, and the business units responsible for managing the risks detected are designated during the identification phase. For each risk, a management strategy and mitigation measures are developed in accordance with the risk management system. Each risk is controlled and monitored.

Information security

FN-EX-550a.3

Moscow Exchange Group continues to implement its information security programme for the years

The Group’s companies have electronic and computer crime and personal liability insurance policies to mitigate operational and information security risks.

FN-EX-550a.1

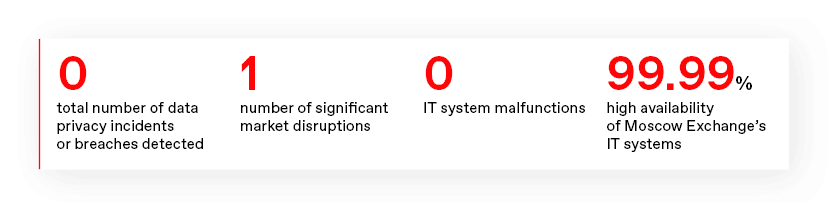

In 2022, MOEX had only one failure that led to the suspension of trading.

On 5 September 2022 at 10:26 a.m. Moscow time, the Exchange revealed the absence of certain client codes in the current configuration of the FX trading and clearing system (TCS), which restricted the ability of individual trading participants to conduct transactions by their clients. Updating the necessary data promptly could take considerable time and cause additional problems for traders, so the Exchange decided to suspend trading on the FX and Precious Metals Markets from 10:50 a.m. Moscow time, which it announced on its website in advance. At 11:57 a.m. Moscow time, the FX Market trading system became available for order withdrawal after the necessary client code data was uploaded and the TCS restarted.

Robust IT infrastructure

In 2022, the Group continued to implement measures to maintain the required level of system reliability. For example, a new disaster recovery data centre NORD Tier II was commissioned and relocating systems from the current backup data centre (М1) began. A VDI project was successfully completed to provide the employees of the Exchange and the operating units with a safe, secure and convenient workplace.

As part of the import substitution programme, multiple tests of equipment and software from Russian providers were carried out, providing MOEX with a large number of reliable suppliers for further system development tasks.

Infrastructural reliability remained at 99.99%. And apart from the short-lived FX Market trading code incident, there were no significant infrastructure failures affecting the availability of critical systems throughout 2022.

Data governance activities implemented:

- development of the previously implemented operational model for data quality management to minimise risks (reputational, regulatory, operational) and increase the level of satisfaction of business users with data services;

- development of flexible methodologies for testing and implementing data monetisation tasks.

Access to products and services

FN-EX-550a.3

Moscow Exchange continues to provide investors and market participants with equal and unhindered access to its products.

In 2022, work continued on developing clients’ personal accounts. Clients will be able to sign contracts and submit applications via a single interface, which vastly improves the client path.

The new SIMBA and TWIME ultra-fast protocols for accessing the Equity & Bond and FX Markets were introduced to clients in the collocation zone.

Finuslugi.ru

The Group continues to develop the Finuslugi personal finance platform by connecting new financial service providers and expanding its product line. In the future, new types of people’s bonds, loans and other products from banks, asset managers and insurance companies will become available on the platform.

The year 2022 saw the following significant updates to the Finuslugi platform:

- new loan services: a loan calculator, a credit rating, a common loan application on the website and in the Finuslugi app, and a Credit History service;

- an additional issue of Kaliningrad bonds;

- in-app marketing push notifications as a convenient channel for interacting with customers to sell products;

- registration in the personal account of Finuslugi was built into the process of purchasing compulsory car insurance (OSAGO), and each customer now has automatic access to Finuslugi personal account;

- in partnership with banks, exclusive deposits were launched on Finuslugi (MKB, Dom.RF, etc.).

Registrar of Financial Transactions

The Financial Transactions Registry (FTR) was launched in 2019 in conjunction with the launch of the Finuslugi platform. Created on the basis of NSD, the FTR accumulates information on all transactions made on any financial platform.

At the end of 2022, the FTR registered information from six financial platforms on six financial products. The number of users was 21,500 individuals and the total number of registered transactions was 82,800. FTR functionality was expanded to process information on new products (bank cards). A tariff model for all instruments was developed and agreed with the Repository Services Users Committee (FTR subcommittee).

Access to transactions with federal loan bonds

In December 2021, the Finuslugi.ru platform launched the first service for purchasing and selling federal loan bonds of constituent entities of the Russian Federation. Russian regions’ guaranteed-income securities will only be traded on the exchange, and no brokerage account will be required to purchase them.

Not only are bonds a tool for improving the financial literacy of the public, they also facilitate ESG projects: funds raised will be used to clean up bodies of water, reclaim landfill sites, and implement urban redevelopment projects.

The Kaliningrad Region’s coupon bonds are available for purchase. The coupon rate is 9% per annum, with a minimum investment amount of RUB 1,000. All the funds raised will be put towards development and improvement of the Kaliningrad Region. Investors will be able to choose a project to invest in, and they will receive a quarterly report on its implementation. Information on implementation of the project will be provided by the Kaliningrad Region.

Consumer lending service

In 2022, Finuslugi doubled its customer base to more than 1 million people. Finuslugi coves all regions of Russia, both major cities and towns of 5,000 people or more. In 81 cities from 2022, customer identification and access to all platform products is on the same day.

During the year, five banks and four insurance companies joined Finuslugi, bringing the total number of banks to 19 and insurance companies to 17. In addition, there are offers from 150 banks and 150 insurance companies on the marketplace.

MOEX Treasury platform

In 2020, Moscow Exchange launched MOEX Treasury, a terminal for corporate clients with direct access to trading. MOEX Treasury allows bidders to perform transactions on Moscow Exchange markets through a single user-friendly interface, including:

- conversion and swap transactions on the FX Market;

- deposits with a central counterparty on the Money Market;

- hedging opportunities on the Derivatives Market;

- deposit auctions in the M-deposits segment.

MOEX Treasury also provides integration with bidders’ personal accounts, as well as access to the Transit 2.0 system, which is an advanced platform used by banks and corporations to exchange financial messages and electronic documents. The solution is based on NSD’s Electronic Data Interchange (EDI) system.

In 2022, a new convenient model for providing access to the MOEX Treasury terminal was

Spectra platform

The Spectra platform provides futures and options trading. A second pricing model was introduced in 2022, providing negative-pricing trading and a mechanism for switching between models.

High-speed market data feeds

In October 2021, a new high-speed derivatives market data feed, SIMBA SPECTRA, was rolled out. The service allows clients to receive market signals faster than all previously available connectivity methods.

The service speed is ensured by a newly-established software interaction between the SIMBA SPECTRA gateway with the central component of the trading system and a high-speed segment of the network infrastructure designed specifically for transmitting large volumes of data to multiple recipients in real time.

The new service implements the Public Data First Public exchange information is published faster than private data. principle and eliminates the need to use multiple sources simultaneously to obtain market signals. The protocol is based on the modern Simple Binary Encoding, which significantly speeds up the process of obtaining and processing market data by clients’ trading algorithms. Similar technologies are successfully used at the largest exchanges worldwide, supporting the trend of development of high-tech client trading systems.

The new service, combined with the TWIME trading protocol, delivers an optimal IT solution for clients whose trading strategies are extremely sensitive to the speed of market data feed and order entry latency.

In October 2022, Moscow Exchange introduced new high-speed market data distribution protocols SIMBA ASTS in the Equity & Bond and FX Markets. The new service is an in-house development of the Exchange and is intended for banks, brokers, algorithmic and high-frequency traders, which co-locate their equipment in the Exchange’s data centre.

The main advantages of the service are:

- speed which is far superior to all existing protocols;

- unified message formats;

- an ability to quickly assess movements of the best prices;

- a dedicated high-speed network infrastructure in the colocation area.

New access protocol for FX and Equity & Bond Markets

October 2022 also saw the launch of FIFO TWIME ASTS, a new access protocol for FX and Equity & Bonds Markets that significantly accelerates the delivery and processing of trade orders compared with the previous FIFO MFIX Trade protocol.

The new service is able to transmit orders to the trading system without waiting for a response on the processing of a previous order (asynchronous order delivery), making trading more convenient for high-speed traders. Strict

- RUB 0 in financial losses resulting from failures of the information security system and cybersecurity;

- no breaches involving personal data leakage or disclosure of confidential information.

Plans for 2023

- review and revise the current strategy;

- review the supply chain and import substitution;

- adapt the technological landscape and infrastructure to the revised strategy;

- introduce new risk management tools, including systems that incorporate machine learning and scenario analysis;

- train staff on anticipating probable events and threats;

- analyse financial and non-financial risks integrated in the risk map;

- audit information security in accordance with ISO 27001 and ISO 22301.