MOEX GROUP’S FOCUS AREAS: ‘GREAT’

G | GENUINE CORPORATE GOVERNANCE AND BUSINESS ETHICS

2-9 3-3

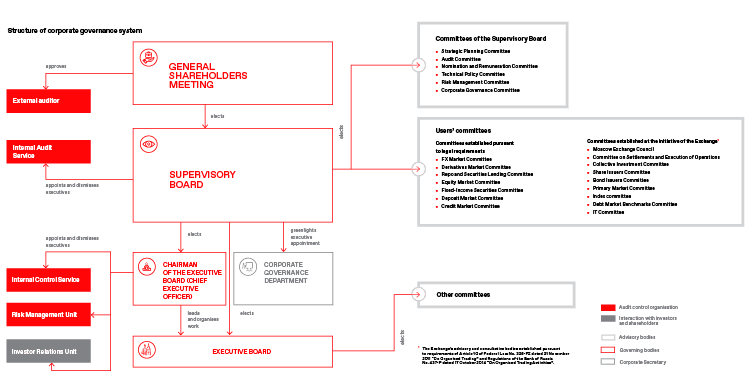

Corporate governance system

Moscow Exchange Group’s corporate governance system is based on Russian statutory rules and recommendations issued by the Bank of Russia, as well as on international best practices and standards. To improve the quality and effectiveness of corporate governance, the system is constantly being improved to align with the requirements of regulatory bodies, the opinions of shareholders and investors, and the Group’s development strategy.

The corporate governance system of Moscow Exchange Group is comprised of the following governing, auxiliary, and supervisory bodies:

- The General Shareholders’ Meeting is the supreme governing body.

- The Supervisory Board handles general and strategic management of the Moscow Exchange’s activities.

- The committees of the Supervisory Board have an advisory role. Their responsibilities include preliminary consideration and the formulation of recommendations to help the Supervisory Board make decisions on crucial issues.

- The Chairman of the Executive Board and the Executive Board itself are the executive governing bodies. They govern day-to-day activities at the Moscow Exchange.

- The Internal Control and Internal Audit services oversee the effectiveness of risk management and corporate governance practices and compliance with legal requirements, corporate policies, and business processes, and also perform other functions. An independent external auditor reviews and confirms the Group’s financial reports.

- The user committees are advisory bodies to Moscow Exchange Group.

- The Corporate Governance Department and the Corporate Secretary coordinate the Exchange’s actions to protect shareholders’ rights and interests.

Moscow Exchange Group operates according to its Corporate Governance Code. It sets out the core principles and objectives of the corporate governance system, including the principles by which the corporation is governed, which must be followed by the companies of the Group. This is a top-level approach to management approved by Moscow Exchange and then integrated at all the companies of the Group. The NCC and NSD strive to implement all requirements relevant to Moscow Exchange in their activities.

Key documents:

- Federal Law No. 208-FZ dated 26 December 1995 On Joint-Stock Companies

- Federal Law No. 325-FZ dated 21 November 2011 On Organised Trading

- Bank of Russia Corporate Governance Code

- Listing Rules of the Moscow Exchange

- G20/OECD Corporate Governance Principles

- Internal policies, regulations and other bylaws, including the following:

- Charter of Moscow Exchange MICEX-RTS PJSC

- Regulation on the Identification and Prevention of Conflicts of Interest by Moscow Exchange MICEX-RTS PJSC When Acting as a Trading Organiser and Financial Platform Operator

- Succession Policy for Members of the Supervisory Board of Moscow Exchange MICEX-RTS PJSC

- Regulation on the Stock-Based Long-Term Incentive Programme for Key Experts of Moscow Exchange MICEX-RTS PJSC

Governing bodies

General Shareholders Meeting

The General Shareholders’ Meeting acts in accordance with Russian legislation and the Charter of Moscow Exchange.

Supervisory Board

The Supervisory Board is the main governing body of Moscow Exchange, acting in accordance with the Charter and the Regulation on the Supervisory Board of Moscow Exchange approved by the General Shareholders’ Meeting. The committees under the Supervisory Board consider issues related to sustainability in accordance with their scopes of authority.

Supervisory Board members are elected by the General Shareholders’ Meeting to sit on the Board until the next Annual General Shareholders’ Meeting. The members of the Supervisory Board are elected by cumulative voting.

2-12 2-14

The competence of the Supervisory Board is defined in the Charter and is delimited from the competence of Moscow Exchange’s executive bodies, which manage its day-to-day activities.

In particular, the Supervisory Board:

- defines the vision, mission, and strategy of Moscow Exchange,

- is responsible for the strategic management of the Exchange and its long-term sustainable development, and

- establishes the strategic goals and key performance indicators of the Exchange.

The Supervisory Board also adopts most internal policies.

Internal and external evaluation

2-18 3-3

In accordance with the recommendations of the Bank of Russia’s Corporate Governance Code and best international practices, the Supervisory Board of Moscow Exchange self-assesses the effectiveness of its activities annually. In addition, an external evaluation involving an independent consultant is carried out once every three years. In 2022, the external evaluation was carried out by Ward Howell, an independent consultant selected by the Supervisory Board following the consideration of several applications.

Remuneration of Supervisory Board members

2-19 2-20

The current system for the remuneration of Supervisory Board members is set by the Policy for Remuneration and Reimbursement of Expenses (Compensations) (the ‘Policy’) and by the latest version of the Regulation on Remuneration and Compensation (the ‘Regulation’), most recently approved by the Annual General Meeting of Shareholders in 2022.

The Nomination and Remuneration Committee takes active part in the improvement of the system of remuneration for Supervisory Board members, taking into account best practices in corporate governance and the experience of other public companies and international exchanges. The Policy and the Regulation apply only to members of the Supervisory Board of Moscow Exchange.

According to the Policy, the remuneration paid to Supervisory Board members shall be sufficient to attract, retain and properly motivate individuals with the skills and qualifications necessary to work effectively on the Supervisory Board.

The Nomination and Remuneration Committee provides recommendations on the remuneration of Supervisory Board members based on an expert assessment of the remuneration paid by Russian companies with similar capitalisations and by competitors of the Exchange.

The Policy and Regulation govern all types of payments, benefits, and privileges provided to Supervisory Board members and provide for no other forms of short-term or long-term incentives for Supervisory Board members.

To ensure the independence of decision-making, the remuneration of Supervisory Board members is not linked to the performance of the Exchange or to the value of shares on the Exchange and does not include stock option programmes. Supervisory Board members enjoy no pension contributions, insurance programmes (apart from liability insurance for Supervisory Board members and the conventional insurance associated with travelling to perform duties as a director or to participate in Supervisory Board activities), investment programmes, or other benefits or privileges unless these are specified in the Policy or Regulation.

The Exchange does not provide loans to Supervisory Board members and does not enter into civil contracts with them for the provision of services to the Exchange, including on non-market terms.

Remuneration for performing the duties of a Supervisory Board member shall not be paid to government officials, employees of the Bank of Russia, or employees or managers of the Exchange or its subsidiaries.

Remuneration of directors for performing the duties of Supervisory Board members comprises basic and supplementary components.

The level of basic remuneration of a member of the Supervisory Board depends on whether the member is independent or not, and:

- for an independent member of the Supervisory Board, amounts to RUB 9 million;

- for a non-independent member of the Supervisory Board, amounts to RUB 6.5 million.

The following differentiated supplementary remuneration is paid to Supervisory Board members for the performance of the additional duties requiring extra time and effort of the Chairman of the Supervisory Board, Deputy Chairman of the Supervisory Board, Chairman of a Supervisory Board Committee, or member of the Supervisory Board Committee:

- for the Chairman of the Supervisory Board, RUB 11 million;

- for the Deputy Chairman of the Supervisory Board, RUB 4 million;

- for the Chairman of the Supervisory Board Committee, RUB 3.75 million;

- for a member of the Supervisory Board Committee, RUB 1.5 million.

To ensure that the remuneration of Supervisory Board members corresponds to changing market demands between cycles of review of the remuneration level, the Regulation provides for the adjustment of the remuneration of Supervisory Board members in line with the consumer price index at the end of the year in which the corresponding composition of the Supervisory Board was elected and accrued starting from 1 January 2022.

The basic and additional remuneration of a Supervisory Board member may be reduced by 50% if the Supervisory Board member has attended fewer than 75% of the meetings of the Supervisory Board or committees in person, respectively. If a member of the Supervisory Board has taken part in 1/3 or fewer of the total number of meetings of the Supervisory Board or its committees or in ¼ or fever of in-person meetings of the Supervisory Board or its committees, the corresponding part of the remuneration is not paid.

In addition to remuneration for work on the Supervisory Board and Supervisory Board Committees, members of the Supervisory Board are reimbursed for travel expenses relating to their participation in in-person meetings of the Supervisory Board or its Committees, General Meetings of Shareholders, as well as events attended while performing the duties of a Supervisory Board member.

As per the current legislation of the Russian Federation, the ‘say on pay’ concept does not apply.

Executive Board

The Executive Board manages the day-to-day operations of Moscow Exchange. The chairman of the Executive Board acts on behalf of Moscow Exchange without the need for a power of attorney. He or she represents its interests, issues orders, gives instructions which are mandatory for all Moscow Exchange employees, and delegates certain powers.

Remuneration of Moscow Exchange executives

2-19 2-20

The system for the remuneration of Moscow Exchange executives is regulated by the Policy on Remuneration and Compensation of Expenses of Executive Body Members. The policy sets out the principles of and approaches to remuneration, and it establishes the procedure for determining the amount of remuneration and the types of payments, benefits, and perks granted to the members of executive bodies. The remuneration consists of fixed and variable components. The variable component accounts for a significant share of annual pay. There are plans to review and implement sustainability KPIs for Executive Board members. Consultants are not involved in determining remuneration.

The total amount of remuneration paid to Executive Board members is assessed by the Nomination and Remuneration Committee to be in accordance with the level of remuneration at comparable companies, based on research purchased from leading consulting companies. Members of Moscow Exchange’s executive bodies are not paid remuneration for their work on the governing bodies of other companies of the Group.

Preventing conflicts of interest

2-15 FN-EX-510a.2

The Policy on Management of Conflicts of Interest and Corporate Disputes has been adopted to prevent conflicts of interest among the members of the governing bodies. The key principles of this policy include:

- a requirement the members of the Supervisory Board, members of the Executive Board, and the Chairman of the Executive Board notify Moscow Exchange of conflicts of interest;

- priority of the interests of Moscow Exchange and its shareholders over the personal interests of the members of Moscow Exchange’s governing bodies;

- contribution of the Supervisory Board to the prevention, identification, and settlement of corporate conflicts;

- priority participation of independent directors in preventing corporate disputes and the performance of significant corporate actions by Moscow Exchange.

A list of affiliated persons is disclosed on the Moscow Exchange website to inform shareholders and other interested parties. See the corresponding report for information on interested party transactions made by Moscow Exchange in the reporting year.

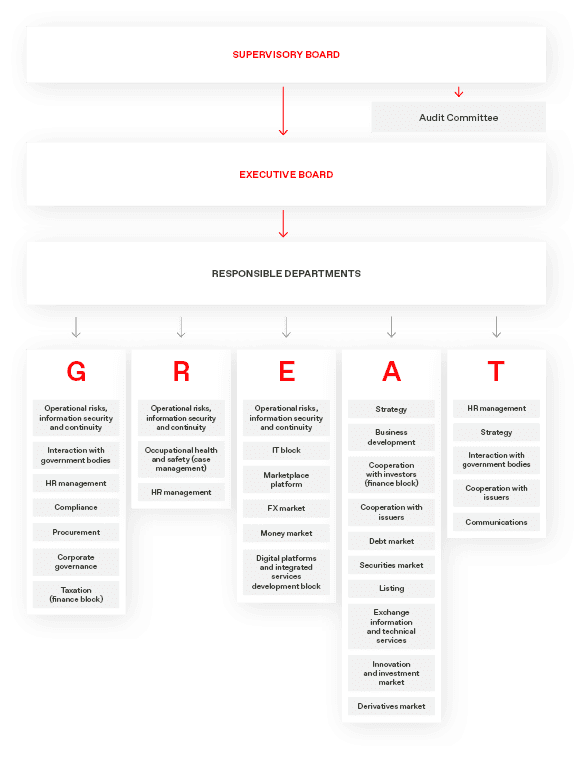

Sustainability management system

2-12 2-13 2-14

Powers related to sustainability are distributed among the Supervisory Board, the Executive Board, and the Chairman of the Executive Board. This distribution is established in the Charter of Moscow Exchange MICEX-RTS PJSC.

In accordance with the Charter, the Executive Board approves sustainability reports.

The Executive Board shapes Moscow Exchange’s overall sustainability agenda and is responsible for operational decisions in this area. In 2021, the Executive Board decided to form the Sustainable Development Goals Working Group (SDGWG). The body was created under the sustainability roadmap, and its functions include the development of goals on economic, environmental, and social aspects. The body convened twice in 2022 and considered the issues of updating the Roadmap for Sustainable Development for 2022 and the targets of the Environmental Policy. The Chairman of the Executive Board manages sustainability activities and may delegate their management to operational subdivisions. The management of the sustainability agenda at the level of operational subdivisions is shown in the diagram.

The Chairman of the Executive Board reports to the Supervisory Board on a quarterly basis on the status and performance of tasks in the following sustainability areas:

- Information security

- Sustainable technological development

- Risk management

- Business ethics and compliance

- Market access and customer relations

- Development of sustainable exchange financing

- Growth Sector and Innovation and Investment Market Sector

- Employee engagement and performance

- Informing issuers about trends, standards and practices in sustainability

- Financial literacy improvement initiatives

Management of the sustainable development agenda at the departamental level is presented in the diagram.

The Chairman of the Supervisory Board and the independent directors are regularly invited to speak at roundtables and conferences which discuss sustainability issues. There is also interaction with government authorities on relevant issues. The chairman of the Supervisory Board may receive enquiries and requests from stakeholders through the feedback form available on the corporate website, and there are also informal channels for interacting with stakeholders. The members of the Supervisory Board are open to dialogue with all stakeholders, including through informal channels of communication, to receive and process enquiries and requests and submit them to management.

Business ethics

Maintaining and developing a culture of trust and responsibility is a key priority of Moscow Exchange Group’s updated strategy. The Group upholds high standards of corporate business conduct and values its reputation. In particular, Moscow Exchange adheres to the following principles:

- zero tolerance principle (aversion to corruption in all forms and manifestations)

- employee engagement principle

- principle of proportionality of anti-corruption procedures to corruption risk

- principle of periodic risk assessment

- principle of mandatory counterparty inspection

- openness principle

- principle of monitoring the efficiency of procedures and their implementation

- principle of accountability and inevitability of punishment

- conflict of interest prevention principle

Key documents:

- Policy on Preventing Corruption-Related Offenses of Moscow Exchange

- Code of Professional Ethics

- Code of Ethics of NSD NCO JSC

- Code of Business Ethics of NCC NCO JSC

- Policy on Preventing Corruption-Related Offenses at NCC NCO JSC

- Procedure for Preventing Conflicts of Interest at NCC NCO JSC

- Moscow Exchange Information Policy

- NCC NCO JSC Information Policy

- Rules of Internal Control of NCC NCO JSC to Combat the Legalisation (Laundering) of the Proceeds of Crime, the Financing of Terrorism, and the Financing of the Proliferation of Weapons of Mass Destruction

- Regulation on the Contractual Activities of NCC NCO JSC

- Information on efforts by Moscow Exchange Group counterparties to prevent money laundering and financing of terrorism

- Moscow Exchange’s Know Your Customer/Counterparty Policy

- Conflict of Interest and Corporate Conflict Management Policy

- Each structural unit of Moscow Exchange is responsible for identifying and assessing risks in its own processes, including corruption-related risks

- Internal Control and Compliance Department

- Audit Committee of the Supervisory Board

2-23

Key principles of the Moscow Exchange Code of Professional Ethics:

- respect for staff and equal opportunity

- respect for staff civil rights, including their right to freedom of speech

- zero tolerance of corruption

- prevention of conflicts of interest

- combating money laundering and the financing of terrorism

- countering the use of inside information

- protection of Moscow Exchange’s assets, including intellectual property rights

- protection of shareholders’ interests

- non-disclosure of confidential information and protection of intellectual property rights

- maintenance of trust-based relationships with customers, partners, and government authorities

- neutral stance towards political and religious activities (the Group’s employees are, however, welcome to engage in such activities at their own expense and as private individuals)

- corporate social responsibility and commitment to sustainability

The Code of Professional Ethics sets out the values that are fundamental to decision-making in the course of Moscow Exchange’s activities:

- openness and decency

- continual development and openness to change

- partnership with customers

- responsibility for the future of the Company

Anti-corruption

The Group’s companies adhere to the principle of aversion to corruption in all forms and manifestations. The Group’s anti-corruption management approaches are defined in top-level documents and local regulations, and they are also specifically implemented in key company regulations (such as procurement regulations).

Key principles of the anti-corruption policy:

- Moscow Exchange prohibits the offering or acceptance of any items of value (including gifts and incentive payments) in soliciting assistance to solve any issues.

- Moscow Exchange prohibits transactions with third parties that would act on behalf of or in the interests of Moscow Exchange.

- Moscow Exchange has corruption risk controls embedded in all aspects of its activities.

- Moscow Exchange incorporates anti-corruption provisions (clauses) into contracts and vets all counterparties.

- Moscow Exchange provides mechanisms for its staff and third parties to report information on corruption risks (including anonymously).

Key documents:

- Code of Professional Ethics of Moscow Exchange

- Regulation on the Identification and Prevention of Conflict of Interest in the Implementation of the Activities of the Organiser of Trading and the Activities of the Operator of the Financial Platform by Moscow Exchange

- The policy aimed at preventing corruption offences

- The new version of the Rules for Reporting Violations and Abuses

Countering Unfair Practices

Measures to prevent, detect and combat the misuse of insider information and/or market manipulation have been developed and are in place at Moscow Exchange, including with regard to the availability of internal documents, the designation of responsible persons, and the enforcement of internal control rules to prevent, detect, and combat the misuse of insider information and/or market manipulation.

Financial monitoring

Moscow Exchange has developed an internal control system to combat money laundering and the financing of terrorism and the proliferation of weapons of mass destruction.

Moscow Exchange has registered with the US Internal Revenue Service (IRS) as a financial institute observing the requirements of FATCA (Participating Financial Institution not covered by an IGA). It has been assigned Global Intermediary Identification Number (GIIN) XNBBND.00005.ME.643.

CRS (Common Reporting Standard) is an international equivalent of FATCA aimed at improving tax transparency and preventing global evasion of taxes. In May 2016, the Russian Federation confirmed its participation in fulfilling the CRS requirements. Organisations in the Russian financial market are obliged to identify customers who are tax residents of foreign countries (territories) and provide data on such customers and their accounts to the Federal Tax Service of Russia.

Compliance for the market

Moscow Exchange creates compliance technologies that help market participants consider their customers and financial instruments through the lens of Moscow Exchange’s experience and to improve the quality of their risk assessment and compliance with the regulatory requirements.

Since 1 July 2019, Moscow Exchange has sent requests for the list of insiders to be provided by bidders via the electronic data interchange system (EDI) to the address of the bidder in Moscow Exchange’s EDI. The Lists of Insiders system developed is intended for the creation, maintenance, accounting, storage, and transfer of lists of insiders to the trade organiser in accordance with Art. 9 of Federal Law No. 224-FZ, dated 27 July 2010, ‘On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation’ (the ‘Insider Law’).

The Lists of Insiders system was designed to provide functionality for the submission of lists of insiders to stock exchanges by entities subject to the Insider Law.

Moscow Exchange guarantees the secure transmission of information over a closed communication channel using SSL connection and data encryption.

In addition, Moscow Exchange mitigates the risks of unauthorised access to the information in the Lists of Insiders system by ensuring that representatives of entities subject to the Insider Law are authorised when they are provided with a login and password to access the system.

Code of Conduct

Moscow Exchange promotes the establishment and propagation of the best compliance practices in the market. In 2021, to establish and maintain standards of good conduct, adherence to which contributes primarily to a favourable investment environment in the Russian financial market, a Code of Conduct was created on the joint initiative of the Bank of Russia, SRO, Moscow Exchange Group, and trading and clearing members. A mechanism for adherence to the Code was implemented, and information on the Code was collected and reviewed. The Code was approved by the Exchange Council and the Supervisory Board of Moscow Exchange.

The Code is advisory in nature. In this, however, taking into consideration the importance of the Code’s goals, Moscow Exchange Group encourages organisations to join the Code and strive to conduct their activities in the financial market in accordance with its principles. To join the Code, organisations must send a signed Declaration of Joining the Code to the Department of Internal Control and Compliance of Moscow Exchange.

If a breach of the Code or a situation requiring attention related to the Code or its scope of application is identified, the relevant information can be forwarded to the Hot Line for Compliance. If necessary, the Bank of Russia, SRO, or other organisations (a working group format) will be invited to consider the respective enquiries.

Key documents:

- Federal Law No. 224-FZ, dated 27 July 2010, ‘On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation’

- Instruction of the Bank of Russia No. 5129-U, dated 22 April 2019, ‘On the Procedure for Transfer by Legal Entities specified in Cl. 1,

3–7, 11, and 12 of Art 4 of Federal Law No. 224-FZ, dated 27 July 2010, ‘On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation’ of the List of Insiders to the Trade Organiser through which Transactions in Financial Instruments, Foreign Currency, and/or Goods are Carried Out, upon its Request’ - Procedure for the Transfer of Insider Lists to Moscow Exchange MICEX-RTS Public Joint-Stock Company dated 22 July 2022

- Code of Conduct

- Department of Internal Control and Compliance.

Mechanisms for reporting instances of corruption and violations of standard business practices

205-2 2-23 2-25 2-26 3-3

The Group created SpeakUp!, a portal for reporting compliance issues, which enables the responsible officers to be promptly informed of possible instances of corruption and violations of standard business practices. The information reported is considered confidentially, and the Group’s anti-corruption policy guarantees

Employees can also use the SpeakUp! portal to get advice on ethical business conduct and anti-corruption. Moscow Exchange adheres to the open-door principle. Employees can also directly contact the compliance department by phone, submit questions via a dedicated email address, and use the internal compliance portal. Information about obtaining advice on business ethics is provided to employees in the course of training on anti-corruption policies and methods.

The following procedure to identify situations showing signs of a breach has been implemented and used at Moscow Exchange:

- A mandatory investigation is conducted.

- If necessary, the responsible department (compliance) may involve other departments in the investigation.

- In the conduct of the inspection, written explanations may be obtained from those who have committed violations, along with other documents necessary for the purposes of the inspection.

- A report is drawn up on the results of the inspection which includes the grounds for and timing of the inspection, the violations found during the inspection, their causes and the persons responsible for them, as well as proposals and recommendations for remedying the violations found and preventing them in the future, which is submitted to the Chairman of the Executive Board of Moscow Exchange.

- Based on the results of the inspection, the Chairman of the Executive Board of Moscow Exchange decides on the imposition of disciplinary and/or material liability actions on the persons who have committed the violations, as well as on sending documents to law enforcement bodies and/or the courts for the imposition of property, administrative, or criminal liability actions in accordance with the laws of the Russian Federation.

To ensure that staff awareness of anti-corruption practices and methods remains high, Moscow Exchange Group provides information to its personnel at several levels:

- Upon hiring, new employees undergo a brief training course and read and sign key documents.

- Whenever the values, principles, or behavioural standards and rules of Moscow Exchange change, staff are informed accordingly through the internal portal and other means of internal communication (the corporate magazine, posters, newsletters, etc.).

- Supervisory Board members who are not employees of Moscow Exchange Group are introduced to new values, principles, standards, and rules of conduct when approving the relevant documents.

- The Group also runs an internal training course that is mandatory for all employees.

Approach to identifying material breach of legislation

2-27 3-3

Pursuant to Moscow Exchange’s Rules for Managing Risks Associated with the Activities of a Trade Organiser and Digital Financial Asset Exchange Operator, any events which lead to the following consequences shall be treated as a material breach of the legal requirements of the Russian Federation:

- Penalties imposed by supervisory bodies in the form of fines exceeding RUB 700,000.

- Possible suspension of certain operations, or the suspension of activities.

- A surge of negative feedback from customers/counterparties in excess of 70% of the average number of negative publications for the previous year.

- Negative information in the media about the management of Moscow Exchange.

- Financial loss exceeding the limit set for the current year for the relevant type of risk.

- Disruption of key Moscow Exchange systems.

- Violation of deadlines for the implementation of key strategic areas by 12 months or more.

- Significant increase in the implementation cost in key strategic areas.

- Significant reduction in the profitability of the strategic areas being implemented.

- Significant reduction in the profitability of key Moscow Exchange products.

- Significant information leaks or successful attacks on key Moscow Exchange systems.

- Other consequences which may have a significant negative impact on Moscow Exchange operations.

Approach to taxation

207-1

The approach to taxation is described in the tax strategy of Moscow Exchange Group. In its tax-related activities, the Group relies on the requirements of tax legislation and considers the effective management of tax risks to be a significant factor in increasing the Group’s value. In 2022, there were no tax disputes with the Group.

The Company values its reputation as a responsible taxpayer and strictly complies with the tax laws in all jurisdictions where it does business. As a major taxpayer, the Group recognises the importance of being a socially responsible business and strives to balance corporate, government, and public interests.

The tax strategy was developed in 2021 and approved in 2022. As of the date of this report, the tax strategy has not been made public.

The Group adheres to the following guiding principles with regard to taxes:

- systemic, consistent, and transparent management of tax-related issues;

- clear allocation of functions and responsibilities among the parties involved in tax relations;

- participation of the Group’s senior management in decision-making on key tax issues, as well as the timely involvement of tax experts in decision-making on corporate issues;

- availability of effective tools for monitoring the implementation of decisions, including the automation of key processes and procedures.

The tax strategy is approved by the Supervisory Board of Moscow Exchange. The tax strategy is revised whenever the approaches set out in the tax strategy are changed.

207-2

The Internal Audit Service (IAS) is responsible for monitoring compliance with the tax strategy and with legal requirements. The tax management system is assessed by the IAS at least once a year. The approach to taxation is set out in the Group’s tax strategy.

Moscow Exchange and the NCC take the following approach to tax risks:

- Tax risks are integral to the Group’s risk management and internal control system. They are identified according to the principles established by Moscow Exchange’s Supervisory Board: continuity, economic feasibility, and efficiency.

- All tax risks identified are subject to assessment and materiality ranking.

- Tax risks are monitored quarterly through control procedures.

The fulfilment of tax obligations is subject to an annual audit procedure and is disclosed in the Group’s annual report.

207-3

Moscow Exchange and the NCC are involved in tax monitoring. The NSD plans to join tax monitoring in 2024. Tax monitoring involves an open dialogue between the companies of the Group and the tax authorities. The exchange of information is facilitated via remote access to the information systems of Moscow Exchange and the NCC, as well as to their accounting and tax reports. This method of providing data to the tax authority allows the Group to promptly coordinate a position with the tax authority on the taxation of planned and completed transactions.

Moscow Exchange has joined the following organisations which discuss issues related to transparent taxation: National Financial Association Self-Regulatory Organisation (SRO NFA), Association of Banks of Russia (ABR), and National Association of Stock Market Participants (NAUFOR). Moscow Exchange is involved in the preparation of amendments to tax legislation based on best practices and representing the interests of financial market participants.

The Group discusses pressing issues associated with the amendment of the tax legislation at working groups, committees, and roundtables. It also prepares draft regulations and requests for clarification of the legislation. It can also analyse, update, and submit proposals to government authorities to amend the tax legislation.

Key documents:

- Tax Strategy of Moscow Exchange Group

- Operational subdivisions: Finance Unit (Accounting, Taxation Group)

- Executive Board of Moscow Exchange (review of risk management regulations)

- Risk Management Committee

- Supervisory Board (taking decisions on the tax risk management policy)

Supply chain management

Moscow Exchange Group emphasises responsible supply chain management and close cooperation with the suppliers of products and services to ensure the economic efficiency of procurement and to mitigate relevant financial and non-financial risks. The Group has a vested interest in developing fair competition in the market and strives to cooperate with reliable and responsible suppliers.

Key documents:

- Regulation on Procurement of Moscow Exchange

- Internal regulations on interaction between Moscow Exchange and other companies of the Group

- Operational subdivisions (procurement initiation, preparation of requirements and terms of reference)

- Procurement Assurance Department (organisation and implementation of procurement)

- Procurement Committee (approval of purchases exceeding RUB 6 million)

- Executive Board of Moscow Exchange (approval of purchases exceeding RUB 300 million)

- Supervisory Board of Moscow Exchange (approval of purchases exceeding RUB 600 million)

Key principles of procurement:

- Transparent procurement: any supplier may fill out a questionnaire on Moscow Exchange’s website. Auctions are held on a B2B digital trading platform.

- Equality, fairness, non-discrimination, and no imposition of unreasonable competition restrictions on participants in procurement: all participants, regardless of the size of their business and their country of registration, enjoy equal rights to participate if the transparency and substantive criteria are met.

- There is no additional bidding stage after the final call for bids is announced, unless there are justified changes in the terms of reference, in which case the process is treated as a new procurement.

- There is no provision of services by suppliers who violate Russian legislation currently in effect, including the Labour Code.

- There is zero tolerance for any corrupt practices.

2-6

The bulk of procurement by Moscow Exchange Group is related to IT, specifically to the development, maintenance, and purchase of modern software and hardware. Due to Moscow Exchange’s specific requirements, its activities often demand unique technological solutions. In most cases, such challenges are solved by consultants and contractors. The Group contributes to the increase in the demand for innovative and high-tech products and services and helps create new jobs in the supply chain.

Supply chain risk management

414-1

Moscow Exchange Group always assesses the economic, financial, and related-party risks associated with all its suppliers, using the latest data for verification (which should be no more than one year old). Suppliers assessed to have a high level of risk are not granted contracts. A supplier found to be dishonest (breaching a contract or bidding requirements) may be disqualified.

In accordance with internal regulations, the procurement documentation includes a link to the corporate portal or an email address where losing bidders can submit feedback on the transparency and fairness of the procurement procedures.

To manage ESG risks in the supply chain, Moscow Exchange Group uses standard contract templates containing clauses stipulating that suppliers must comply with Russian legislation (including the Labour Code), as well as a clause emphasising the Group’s zero tolerance for corruption and bribery. In the agreements concluded between Moscow Exchange Group and its suppliers, the parties warrant that their employees will not offer, solicit, or consent to any corrupt payments (in cash or valuable gifts) to any persons, nor accept such money or gifts.